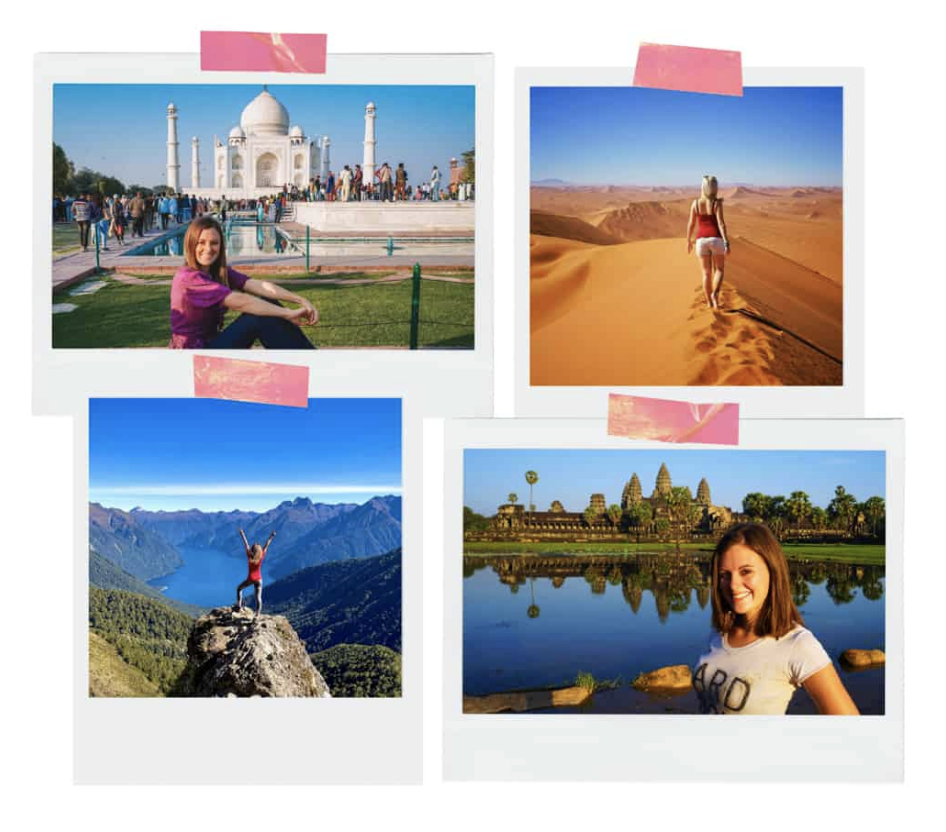

Meet Lauren

Hi! I’m Lauren and I’m the founder of Never Ending Footsteps. I’m here to help you explore this planet safely, adventurously, and affordably.

It was back in 2011 when I quit my job to travel the world. Twelve years, 100-odd countries, and one successful travel blog later, I’m still going.

This website is the result of tens of thousands of hours of on-the-ground research. I pay for all my travels myself, don’t take sponsored trips, and travel anonymously; all to ensure my recommendations are ones you can trust.